Maasvlakte Light, Maasvlakte, Netherlands

This lighthouse is an active lighthouse in an industrial area in Rotterdam. The lighthouse stands at 216 feet tall and is the 12th tallest traditional lighthouse in the world. The lighthouse is also the second tallest concrete lighthouse in the world and the tallest lighthouse in the Netherlands.

Bicentennial Lighthouse, Cordoba, Argentina

This lighthouse is a monument located in Argentina. The lighthouse stands at 335 feet tall and was opened in 2011.

*Feel free to send us your photos of Lighthouses to be featured in our weekly market observations.

Bitcoin tumble

Bitcoin and other cryptocurrencies took another tumble on Monday morning, slipping below key technical support levels as sentiment for digital assets continues to erode. The price of Bitcoin fell 6.8% over 24 hours to $85,000. Bitcoin is now down 22.5% over the last month (as of Monday, December 1st, at 4pm). This is Bitcoin’s lowest price since April.

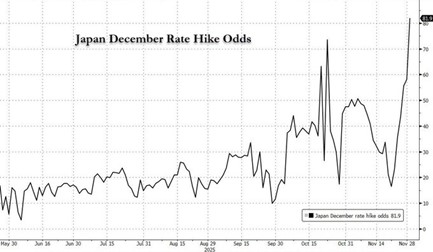

The main driver of Monday’s fall was a signal from Japan’s Central Bank that a rate hike was more likely. The Yen carry trade has been a key liquidity supplier for assets, including cryptocurrencies, for years. The Yen carry trade is an investment strategy where investors borrow in Yen, which has lower interest rates than other currencies, and then convert it into another currency to buy high-yielding or riskier assets. The Yen has been a fuel for markets; higher rates in Japan mean less fuel going forward.

The Bank of Japan Governor stated that he and his colleagues would weigh the pros and cons of raising interest rates and stated that the new Japanese Prime Minister would support the Central Bank’s policy tightening effort. Japanese 10-year yields hit 17-year highs after these comments. Japanese interest rates have been extremely low for years due to deflationary pressures, an aging population, and structural economic challenges. The Japanese Central Bank kept rates close to 0% for a long time to stimulate economic growth and combat mild deflation. After these comments, the Bank of Japan’s rate hike odds hit 81%.

Bitcoin and crypto were not the only asset classes that moved lower on Monday; equity markets also moved lower, and U.S. interest rates moved higher. Bonds across the world sold off on Monday, including U.S. Treasuries. The Yen carry trade was used for various asset classes, including U.S. Treasuries, which yielded much more than Japanese bonds. The increase in rates in Japan will increase domestic bond demand and entice investors to keep funds in local bonds rather than assets like U.S. Treasuries.

Japan is also the largest holder of U.S. Treasuries ($1.1 trillion). In recent years and months, they have slowly sold off some of their holdings, something that could be a big issue for the U.S. if it continues. There is growing worry that demand could be softer for Treasuries moving forward, which is a big issue as the U.S. is currently issuing debt to cover annual deficits.

The other major factor that moved cryptocurrencies and Bitcoin lower is overall economic uncertainty, which is on the rise. High-risk assets generally perform the worst during recessions and in times of uncertainty.

OpenAI issues a red flag

OpenAI has reportedly issued a red flag to its staff regarding the state of the AI industry. OpenAI CEO Sam Altman reportedly circulated an internal memo on Tuesday to his staff. In the memo, Altman declared a code red effort to improve ChatGPT and will delay other initiatives such as advertising, AI agents for health and shopping, and a personal assistant to redirect resources. This response comes as Alphabet has upended the industry after launching its Gemini 3 AI model last month. The AI model has made an immediate splash, winning strong reviews from users and analysts. The model has also beaten OpenAI’s latest GPT 5.1 on benchmark tests.

OpenAI, for the first time, is at risk of losing its crown as the leading AI company to Alphabet. This would be bad news for Altman, OpenAI investors, and key partners/investors such as Oracle and Microsoft.

Over the last month, Alphabet shares are up 12% while Microsoft shares are down 6% and Oracle shares are down 23% (as of Tuesday, December 2nd).

The worry for Oracle and Microsoft is that OpenAI’s efforts to keep up with Alphabet will push back the timeline for making a profit and raise questions regarding sustainability and competitive advantage. OpenAI has made over $1 trillion in spending commitments, including $300 billion in a cloud computing deal with Oracle and a $250 billion deal with Microsoft. OpenAI is valued at $500 billion and expects to have revenue of $20 billion this year.

OpenAI’s investors are banking on profitability and increased revenue from advertising, subscriptions, and other sources to fund the company’s spending commitments. OpenAI has said annual revenue will reach $100 million by 2027; however, that trajectory could be derailed if Alphabet’s Gemini continues to gobble up market share and delay its monetization efforts.

In recent months, Alphabet’s Gemini has grown much faster than OpenAI’s ChatGPT in terms of active users. Gemini is also set to power Apple’s Siri early next year, which would further accelerate growth.

OpenAI does not only face competition pressure from Alphabet, a Chinese counterpart that broke the technology sector for a few days last year, but DeepSeek released its latest large language models and claims its models perform similarly to OpenAI’s GPT across multiple benchmarks.

This increased competition in the AI space could spell poorly for several companies that are banking on OpenAI. Gemini’s growth and adoption also give Alphabet another point over its big tech competitors. We have for a few years stated that Alphabet presents the strongest investment case amongst the biggest tech firms. Alphabet still only trades at 25x forward adjusted earnings, making it attractively valued compared to the other tech giants. The company has a far stronger balance sheet and financial outlook to compete in the AI race, providing better odds of success against the cash-burning AI-focused businesses. Even Warren Buffett purchased Alphabet shares recently.

We do not have a large position in Alphabet across our investment accounts due to timing, other opportunities, technology exposure in the Alternative Asset Trust, and performance; however, on a relative basis, we still think it presents the most compelling case amongst the tech giants.

Two very different arguments on AI

This week, we read about two arguments regarding AI that we wanted to share. One is a bear case outlined by The Economist, and one is a bull case from JP Morgan.

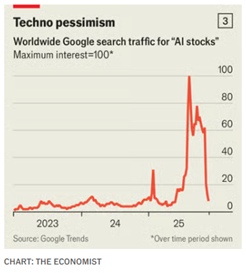

On the bear front, the Economist highlighted Google search traffic in the AI equity space, which has plummeted in recent months:

The Economist states that in recent years, Google search trends have done a much better job than valuations at forecasting imminent falls. Here are 12-month returns of various investment trends since 2008, following the peak in internet searches:

The list encapsulates some of the hype trains that we have critiqued in this publication’s history, including meme stops like GameStop, ARKK (Cathie Wood’s ETF), and SPACs. The drawdowns after this peak are large and often rapid. Google search for “AI stocks” peaked in the summer, but AI stocks have continued to march higher. However, in the first 3 weeks of November, Nvidia and the Philadelphia semiconductor index saw drawdowns of more than 10% reflecting the elevated volatility of the industry (which we all know). Google search trends reflect retail interest, which has seemingly declined rapidly this year and perhaps reflects the overall state of the economy.

Perhaps in a year, we will look back and realize this search trend reflected the AI bubble deflating (albeit slower than past bubbles that burst) in front of our eyes.

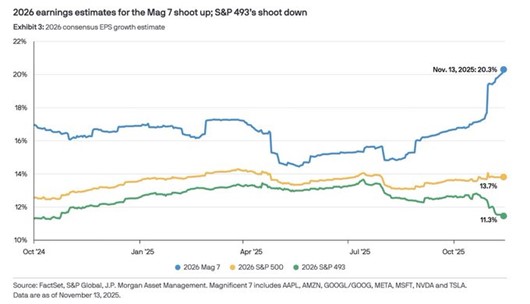

On the bull front, JP Morgan published sell-side research claiming that AI is not in a bubble because the cycle is being funded by cash flow, real demand from customers, and real infrastructure. They also claim markets are struggling to price the technology, which is compounding far faster than historic expectations. In the report, they also revised their earnings expectations for 2026, where the Magnificent 7 (which includes all the technology giants who are mostly all in on AI) earnings estimate increased to 20%, the highest since they started tracking 2026 earnings estimates, and the rest of the S&P was revised lower to 11.3%.

JP Morgan is arguing that higher earnings estimates and cash flows fueling investment are reasons why we are not in an AI bubble. While we understand their logic, we disagree, as most of the industry is relying on a few companies that are making massive commitments and fueling this growth. If this continues, there will be even more deviation between the Magnificent 7 and the AI giants and the rest of the S&P 500.

Earnings week for Canadian banks

This week, Canadian banks reported their latest earnings, kicked off by Scotiabank on Tuesday, RBC and National Bank reported before the bell on Wednesday, and TD, BMO, and CIBC reported before the bell on Thursday. It is not unusual for competitors to report earnings over the same period.

These earnings are very important to Canadian financial markets, as the banks are behemoths in Canada. RBC is Canada’s largest company (in terms of market capitalization), TD is 3rd, BMO is 6th, Scotiabank is 7th, CIBC is 10th, and National Bank is 24th. Bank earnings are deeply intertwined with the real economy as they dominate TSX’s weight and earnings profile. The banks also signal to analysts and investors consumer and business health, systematic risk, and a read-through on credit cycles, especially in Canada, where they compete in an industry that a select number of companies dominate the market.

2025 has been a very strong year for the big six banks. Pre-earnings this week, all six outperformed the TSX 60. After a flat few years, Canadian bank shares have soared, led by TD shares, which played catch-up after a few scandals plagued share performance (money laundering and fines in the U.S.). So far in 2025, the big six Canadian banks have posted some strong earnings reports highlighted by revenue growth and net income increases, which have been driven by higher interest margins, fee income, and lower-than-expected credit provisions. Third quarter net income for the Big Six reached $16.8 billion, surpassing analyst expectations, highlighted by RBC net income jumping 21% YoY, CIBC 17%, and BMO 25%.

In terms of fourth-quarter numbers, which were reported this week, Scotiabank beat estimates despite a large restructuring charge. The company beat street estimates for adjusted EPS and revenue. Both numbers increased YoY substantially, driven by strength in wealth management and capital markets business. On an adjusted basis, Scotiabank earned $1.93/diluted share, up from $1.57 last year. Analysts expected adjusted earnings to come in at around $1.84/diluted share. Fiscal 2025 net income decreased from $7.9 billion last year to $7.76 billion this year. However, adjusted net income for the fiscal year increased substantially YoY from $8.63 billion to $9.51 billion.

The bank realized a $373 million restructuring charge due to job cuts across its global operations as a response to uncertainty. This charge was taken by the bank to simplify its organizational structure in Canada, restructure and right-size Asia operations, and regionalize activities across its international footprint. Scotiabank also reported that provisions for credit losses increased to $1.11 billion from $1.03 billion a year ago and $1.04 billion in the third quarter. The bank pointed to macro uncertainty, trade tensions, and rising mortgage delinquencies in select Canadian markets as key risks that the firm is monitoring.

On the company’s earnings call, management reiterated expectations for double-digit earnings growth in 2026. The bank also remains optimistic that the recent federal government budget will contribute to improved sentiment across the economy. The company repurchased 10.8 million shares in 2025. The earnings call reflected optimism and confidence from management, who continue to forecast an upward trajectory and resilience.

These robust earnings results demonstrate Scotiabank’s resilience and improving earnings power through its diversified business model and strategic actions in 2025.

RBC also reported strong figures, which resulted in an increase to its quarterly dividend of 6.5% after recording record net income. RBC saw higher earnings in most of its business segments, led by capital markets and wealth management. Net income in capital markets and wealth management beat street estimates in the fourth quarter.

RBC recorded quarterly net income of $5.43 billion ($3.76/share), up from $4.22 billion ($2.91/share) a year earlier. For its fiscal year ending Oct. 31, RBC had net income of $20.4 billion, up 25% compared to fiscal 2024. RBC has repurchased 12.27 million shares in 2025, with ongoing buybacks planned until 2026, targeting up to 35 million shares overall under the current authorization.

RBC has also set aside more in provisions for credit losses than last year, as impaired loans continue to rise in both its commercial and personal portfolios.

RBC’s CEO stated that the economy has started to grow, but there is still elevated hesitancy driven by several factors, including Canada’s unresolved trade dispute with the U.S. He went on to say that the economy’s polarization continues to increase, pointing to the deviation in economic conditions between low-income and high-income households. RBC also mentioned similar comments to Scotiabank in terms of the federal budget and optimism, believing that it could attract foreign investment and stimulate growth. RBC stated that its outlook for 2026 is conservative as it is struggling to see a significant acceleration in mortgages or commercial activity. RBC also updated its medium-term target for return-on-equity, setting it at 17% or better, opposed to the previous target of 16%. RBC has also realized higher-than-expected cost synergies from its recent HSBC Canada acquisition

RBC’s strong figures, dividend increases, and lift to ROE guidance are strong signs for shareholders in today’s market.

We expect the other major banks to report similar figures this quarter and shares to respond positively to these prints. Most banks are trading percentage points off 52-week highs. Scotiabank and Royal Bank shares have not had large reactions to this week’s earnings so far.

Management continues to buy back shares across the industry despite the run shares have gone on in 2025, signaling a commitment to returning capital to shareholders and that management still sees value in the current share prices.

On a valuation front, most of the big six are trading at the upper end of their historical valuation ranges in terms of earnings and book value. From a fundamental standpoint, we would wait for a pullback before initiating a position at these levels.

Strong numbers in wealth management and capital markets business segments at banks have been a trend this year, as 2025 has been a year of increased trading activity, deal-making, and consolidation in wealth management. We expect these numbers to continue to increase moving forward, barring some major drawdown in financial markets. We also expect loan delinquencies to continue to rise, especially in Canada, which could impact earnings for banks and other institutions down the line. Do not be surprised if Canadian banks continue to hike their provisions for credit losses in the coming quarters.

Disclaimer: MacNicol & Associates Asset Management holds shares of RBC (RY: TSX) and select other Canadian banks across select client accounts.

MacNicol & Associates Asset Management

December 5th, 2025

Download in PDF format:

The Weekly Beacon -December 5 2025