Urk Lighthouse, Urk, Flevoland, Netherlands

This lighthouse was built in 1845 by famous Dutch architect J. Valk. The lighthouse stands at 18.5 meters tall and has a nautical range of 33 kilometers.

Eleuthera Lighthouse, Eleuthra, Bahamas submitted by David M.

This lighthouse station was originally established in 1903. The lighthouse stands at 19 meters tall. The lighthouse sits on a beach that is an iconic destination on the island of Eleuthera.

*Feel free to send us your photos of Lighthouses to be featured in our weekly market observations.

Record leveraged buyout

Over the weekend, it was announced that video game giant Electronic Arts would be going private via a leveraged buyout from a consortium of investors. Electronic Arts will be taken private at a valuation of $55 billion, a record amongst private LBOs.

Electronic Arts agreed to terms with Silver Lake, a leading technology firm; the Saudi Arabian sovereign wealth fund; and Affinity Partners, a Florida-based investment firm run by Jared Kushner, to go private. Buyers will pay $210 a share in an all-cash transaction. The price paid by the consortium is 25% above the unaffected closing share price for EA on Thursday. The consortium will acquire 100% of EA shares. The Saudi Arabian sovereign wealth fund already owns almost 10% of EA.

EA shares rallied after the announcement but are trading below $210. The deal is expected to face some regulatory scrutiny and is anticipated to close in early 2027. The current CEO will remain in charge of EA after this deal closes. The deal is pending board approval, and no other offers are expected as the group is paying a premium for EA.

The investment consortium will contribute $36 billion of equity, including an existing 10% equity stake already held by the Saudi Arabian sovereign wealth fund, and borrow $20 billion from JPMorgan Chase to close the deal. Private equity groups typically utilize more leverage in these types of deals to boost returns. According to numerous analysts, this could lower the sponsors’ internal realized return (IRRs typically measure the performance of LBOs).

The investment consortium is paying twenty times EA’s estimated fiscal year EBITDA. Numerous industry experts stated that the group is overpaying for EA and, therefore, must be very bullish about EA’s upcoming product launch of Battlefield. The launch of Battlefield could be a real catalyst for EA that could help expand earnings and revenue moving forward.

EA was founded in the early 1980s and is a leader in the video game industry. EA’s portfolio includes NHL, UFC, PGA, Madden, Battlefield, and many more. Last year, EA laid off 5% of its workforce.

We do not own EA shares and probably will pass on buying them at these price levels. We think there is no arbitrage opportunity with the security at this level, as they are trading only 3% off the offer price that will be paid out 15+ months down the road, you could earn that in a money market fund over the same period.

Gold’s fresh all-time high

Early on Tuesday morning, spot gold prices hit a fresh all-time high. The precious metal has been on fire over the last few years. Currently, gold is on pace for its best year since 1979.

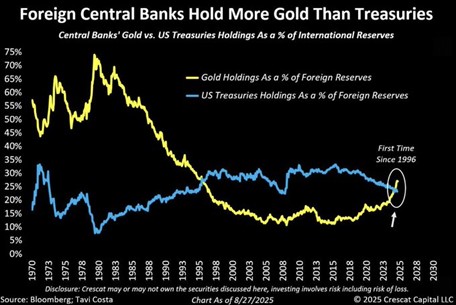

Uncertainty, global tensions, tariffs, valuations across public markets, and a few other factors have led to this surge. Just a few days ago, it was reported that India’s gold and silver imports more than doubled month over month in September. Central Banks continue to dump U.S. Treasuries in favour of precious metals. According to Bloomberg and Crescat Capital, foreign Central Banks now hold more gold than U.S. Treasuries for the first time in almost 30 years.

The U.S. Dollar has lost its shine this year, and U.S. Treasuries are experiencing the same trend. This capital rotation is something we mentioned late last year. It was part of our bull thesis for gold (and partially silver), Central Banks want stability in a time of uncertainty. Some Central Banks also want to eliminate the U.S. Dollar’s control over global trade, so it makes sense that they are dumping U.S. assets in their reserves. This shift is part of a broader de-dollarization strategy.

We think the U.S. Dollar will not be the only loser in this drawn-out shift. Numerous other currencies will lose out. We are in the early to mid-stages of a long-term cycle where we think investors will pay a premium for assets like precious metals, which provide stability and a safe haven in times of uncertainty. We will also remind our readers that precious metals provide a hedge against inflation, something that could begin to heat up once again in the coming months.

On Wednesday morning, gold prices hit new all-time highs amid new uncertainty stemming from the U.S. government shutdown.

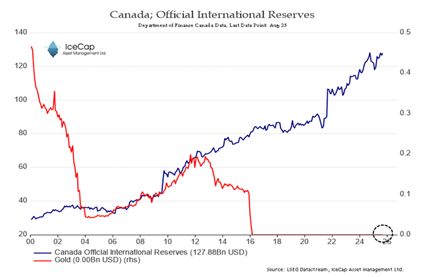

As gold hits an all time high, we again as Canadians must show another chart:

The Bank of Canada and the Canadian government dropped the ball in the mid-2010s by selling off all the gold reserves our country held. An all-time fumble by our leaders!

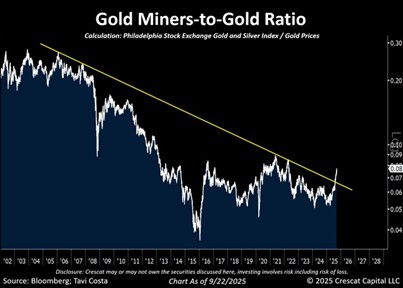

In our eyes, gold miners and other precious metal mining companies are even more attractive than physical metal at these price levels as their free cash flow continues to grow, and their margins expand. Some investors are just noticing these figures; we have been in the trade for quite some time. Miners are also attractive on a historical level when compared to the physical price of gold. According to Crescat Capital, the Gold-Miners-to-Gold ratio is at multi-year lows and just recently began to break out. We expect this breakout to accelerate and the shift into miners to continue to unfold. Some fund managers and allocators who have remained on the sidelines of gold over the last few years will not be able to pass up the value that exists in the miners in the coming quarters.

Disclaimer: MacNicol & Associates Asset Management holds shares of trusts, mutual funds, and ETFs that hold physical precious metals as well as ETFs and stocks that mine gold and other precious metals.

Consumer confidence continues to slip

Consumer confidence fell sharply in September due to labor market worries. The Conference Board said the consumer-confidence index dropped to 94.2 from 97.8 in September, the lowest level since April. Economists had forecasted the index would only drop to 96.0, but it fell much more. Consumers are very worried about job availability, according to economists.

The CB Consumer Confidence Index moving lower reflects consumers being less optimistic about the economy’s future, which could eventually lead to a decrease in domestic consumer spending.

A forward-looking confidence gauge also dropped in September. The index, which looks six months ahead, has been below 80 since February. An index figure below 80 has historically been seen as a sign of a recession. According to Elizabeth Renter, a U.S. economist, people are pessimistic as it’s too difficult to upgrade a job, interest rates remain high, tariff threats remain high, and economic policies are changing almost every week.

The poor job numbers continued on Wednesday morning when the latest ADP National Employment Report was released, which indicated that the U.S. lost 32,000 jobs in the private sector. Those surveyed by FactSet expected growth of approximately 50,000 jobs in September. August’s initial number was also revised in the data dump, falling from 54,000 jobs added to a decline of 3,000 jobs. After this data was released, the FOMC FED Watch Tool rate cut odds surged to nearly 100%.

Investors and policymakers could face a blackout in terms of economic data if a spending Bill is not passed on Capitol Hill and the government faces a shutdown. Should the spending Bill be resolved by Friday, the Bureau of Labor Statistics is expected to release payroll data for September. Insiders expect small growth.

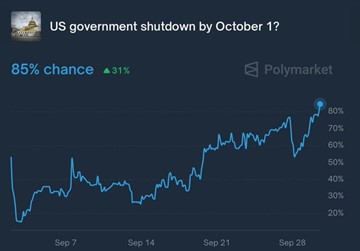

As of Tuesday, at noon, just a few hours before the government could shut down, Polymarket had the odds of a shutdown at 80%:

Quite a stalemate across the aisle. If the government shuts down, thousands of workers at the federal level will miss paychecks as soon as this week. There are also other ripples if this happens that will impact markets, the FED, the economy, and more. The Congressional Budget Office estimates that 750,000 federal employees could be furloughed without pay if the government shuts down. While the workers would not be paid for the duration of the shutdown, they would get back pay after funding resumes. It adds up to $400 million a day. Other things that will be impacted include delayed IPOs, drug approvals, and other government-related activities.

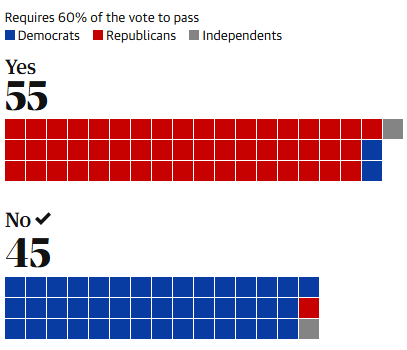

As of Wednesday morning, no deal had been reached, which means the government is shut down. Odds markets predict that the government will shut down for 9 days. The Senate attempted to pass the Bill late on Tuesday night, but the Bill failed to pass the vote threshold needed to pass it. The Bill vote came in at 55-45 in favor, with 2 Democrats and an Independent voting in favor of the Bill alongside Republicans.

Over the years, the government has shut down approximately 20 times, the first coming in 1976. On average, the government is shut down for 8 days. Historically, the S&P 500 has been flat over these periods. However, during the most recent shutdown in late 2018 – early 2019, the S&P 500 rose over 10%.

Is your electric bill surging?

Wholesale electricity prices across the U.S. are on the rise as AI data centers consume more and more energy. Over the last five years, wholesale electricity costs have increased as much as 267% across parts of the U.S. Globally, data centers are expected to consume more than 4% of electricity by 2035. If data centers were a country, they would rank 4th in electricity use, only trailing India, China, and the U.S. In the U.S., power demand from data centers is set to double by 2035 to 9% of all demand. Some analysts predict this will be the biggest surge in U.S. energy demand since air conditioning caught on in the 1960s.

This surge has led to everyday households in select areas of the U.S. paying for the digital economy. Prices have surged the most in the northeast and on the West Coast. The states where data center energy demand has the most impact on the grid are Virginia, Oregon, Iowa, Nevada, Utah, Nebraska, and Arizona. Most of the power in the U.S. is run off state or regional grids, where the system operators manage the trading of energy. These wholesale commodity costs are passed on to utility bills, which include charges for expanding the grid.

More than 70% of the areas that saw price increases over the last 5 years are located within 50 miles of significant data center activity.

This trend will continue as big tech firms continue to increase their capital expenditures for AI and data centers. In 2024, Amazon, Microsoft, and Alphabet spent more than $200 billion on cap-ex. These firms are looking to solve the issue by partnering with nuclear power companies and investing in new reactors and upgrading existing plants.

We continue to evaluate and own various energy and utility providers across North America. We think select industries across the two sectors will create outsized returns over the next decade for investors.

Disclaimer: MacNicol & Associates Asset Management holds shares of energy and utility companies across North America in various client accounts.

Record quarter for M&A

Jeffries’ investment banking division notched a record quarter, reflecting higher values on merger and acquisition deals. This data point lifted profits firmwide by 34%.

Both the firm’s investment banking and capital markets divisions had higher revenue than in the previous quarter and compared to a year ago.

This should be welcome news for those who hold bank stocks that report earnings in mid-October.

The CEO said the results are encouraging and reflect the rebound in global market sentiment. He stated that higher revenues from advisory work were driven by an improvement in the environment for M&A and capital formation. In other words, there is a rebound in deals, which is the result of a more pro-business administration that is not restricting as many deals. The company remains optimistic about the near-term and long-term outlook.

Both revenue and earnings topped analysts’ expectations and beat quarterly results from last year. Jeffries’ shares are down close to 18% this year while broader U.S. financial ETFs are up over 10%.

We do not hold Jeffries’ shares but are mentioning this as this is encouraging news in a time of uncertainty ahead of some big earnings prints in the financial sector.

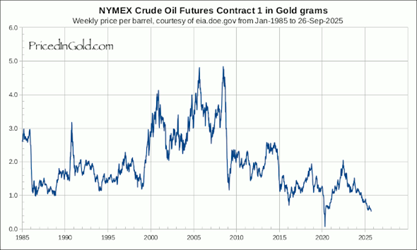

Cheap oil

Oil is currently the cheapest it has been in over 70 years when denominated in gold. The only exception over the last 70 years came during the COVID-19 crash when oil prices plunged due to global lockdowns. For those who have a great memory, oil temporarily traded at a negative price in the spring of 2020.

So why does this matter? We think oil is cheap and there will not be much downside from here (unless Russia or the Saudi’s flood the market). Numerous petrol states require oil to trade at much higher prices to finance various initiatives, including fiscal budgets. We think the most likely scenario is that oil remains in the current range, the market gets flooded with excess supply sometime in the next two years and then oil eventually moves much higher. Our point is, do not give up and sell all your oil and energy exposure. We think there is a lot of value in the sector and some upside to be had.

Disclaimer: MacNicol & Associates Asset Management holds shares of energy companies listed on the TSX, NYSE, and Nasdaq across various client accounts.

MacNicol & Associates Asset Management

October 3rd, 2025

Download in PDF format:

The Weekly Beacon October 3 2025 US