Bari Light, Bari, Italy

This active lighthouse is located on the west side of the harbour of Bari on the Adriatic Sea in the southern region of Italy. The lighthouse was originally constructed in 1869 and stands at 203 feet tall.

Calcanhar Lighthouse, Touros, Rio Grande do Norte, Brazil

This 203-foot-tall lighthouse is the nineteenth tallest in the world as well as the tallest in Brazil. The lighthouse is located in an area known as “Esquina do Contnente” (Corner of the continent). The lighthouse has a 277 step spiral staircase that leads to an observation platform.

*Feel free to send us your photos of Lighthouses to be featured in our weekly market observations.

Details emerge

Over the past two weeks, we have discussed Intel’s major moves. These strategic moves by Intel come at a time when the company continues to trail further behind in the AI race. The two announcements, of course, are large organizations (SoftBank and the U.S. government) taking substantial stakes in the semiconductor company.

SoftBank announced a $2 billion investment into Intel in a move that many see as a lifeline for the iconic U.S. chipmaker. SoftBank’s investment makes it Intel’s 6th largest shareholder overnight. This investment also adds to SoftBank’s ambitious bet on semiconductors and AI assets that include numerous U.S. firms and projects.

A few days after SoftBank’s announcement, it was reported that the U.S. government would also be making a large investment in Intel. According to reports, the government will make an $8.9 billion investment in Intel. These funds come from past Bills already signed and essentially convert grants into equity for the government.

The share purchase will come in either two or three parts. The first tranche will come through a 275 million share issue to the Department of Commerce in exchange for $5.7 billion. This investment comes through unpaid grants from the 2022 CHIPS and Science semiconductor subsidy law. This values Intel shares at $20.74 (Intel shares have surged since this deal was announced but have broadly traded within this range for the better part of the last year). This part of the deal closes August 26th, a few days before this publication is distributed. It is also important to note that $1.5 billion of the $5.7 billion had already been allocated to Intel pending progress on its new Ohio campus, which has been shelved for at least a few years.

The second tranche of the deal is more flexible. This investment is tied to Intel receiving payment for Secure Enclave, a special military project. The $3.2 billion disbursement from the government would give the U.S. government 159 million shares, valuing them at $20 per share.

The final stage of the deal gives the government 241 million warrants. The warrants expire in 5 years and are convertible into common stock if Intel’s stake in Foundry falls below 51%. Those warrants convert at $20 a share.

The government’s stake in Intel after the first two tranches of this deal close would be 9%. If all warrants are exercised, ownership would increase to 13.3%. The Commerce Department’s shares have full voting rights, but it agreed to vote with Intel’s board of directors on all issues. Intel announced that the deal is dilutive to current shareholders. The share purchase from the government comes with a one-year lockup. As of August 26th, 2026, the government can freely sell its shares in “broadly syndicated offerings which could put major downward pressure on the price of Intel shares in a year’s time.

Intel has had a rough few years as it has fallen behind in the chip race. Last year, the company’s CEO resigned after being pushed by the Board to retire due to poor performance and a disastrous tenure. President Trump has been highly critical of Intel’s new CEO. He has demanded his resignation on numerous occasions due to the CEO’s ties to China.

On Monday, Intel warned the public and shareholders that this investment from the Department of Commerce has major risks. The U.S. government ownership could impact international sales and limit Intel’s ability to receive future government grants. Sales outside the U.S. accounted for 76% of Intel’s revenue last year, and 29% of its revenue came from China. How are foreign governments going to treat Intel moving forward due to this partnership? You would have to be naïve to say the same. The company’s filing also warns shareholders that this deal could impact Intel’s ability to pursue transactions that benefit shareholders.

Despite Intel’s reservations regarding the deal, the firm stated that it looks forward to working with the government and believes it will be a great partner.

It appears that Trump is flexing his muscles and jumping back into the corporate world despite sitting in the Oval Office. We will be very clear with what we think regarding this deal; we do not like it. The government does not belong as a major shareholder in a large firm like Intel. The deal sets a bad precedent for government partnerships moving forward. We will not be buying Intel shares for the time being.

AI company makes a splash

One of our AI darlings, which we purchased a few years ago, announced a large acquisition earlier this week. Vertiv Holdings announced on Tuesday morning that it had acquired Waylay NV, a Belgium-based software maker. Vertiv will use the company to improve current operations. The company wants to use generative artificial intelligence to manage its power and cooling systems.

For those of you who forget what Vertiv does, Vertiv is not an AI company in the sense of a chipmaker or a search engine. The company makes power and cooling solutions for data centers, which power AI. We have long thought that during this AI-driven capex wave that this is a safer bet than many of the traditional AI companies. Vertiv is a strong play on the secular growth in high-density data centers and AI-driven infrastructure. Vertiv is a critical player in the space and is a key supplier of power, cooling, and services solutions optimized for AI workloads and high-performance computing.

Vertiv will integrate Waylay’s AI-powered software to support and optimize its data center systems. The acquisition further accelerates Vertiv’s vision of intelligent infrastructure with augmented predictive capabilities. Vertiv did not announce specifics on the deal.

Vertiv shares moved slightly higher on this news. Sell-side analysts pointed to improved operational efficiencies and mitigating downtime risks as potential outcomes of this acquisition.

Vertiv revenue has been growing quarter over quarter, driven by strong demand for its critical data center infrastructure. Vertiv is exposed to certain risks that we must mention when talking about the company from an investment standpoint. The risks include execution challenges, supply chain complexities, and overall industry spending. AI data centers continue to need to grow for Vertiv to continue growing organically.

Disclaimer: MacNicol & Associates Asset Management holds shares of Vertiv Holdings (NYSE: VRT) across various client accounts.

Americans not slowing down

Despite tourism slowing down in select areas across the U.S. this year, analysts believe Labour Day weekend travel will set a record. It is no secret to Canadians that people are travelling less down south this year. Many are opting to travel within Canada or to go abroad rather than visit the U.S. The same could be said for many Europeans who are choosing not to travel to the U.S.

Despite this trend, TSA forecasts that 17.4 million people will travel through U.S. airports between Thursday, August 28th, and Wednesday, September 3rd. This year’s estimate beat last year’s number, which is the current Labour Day weekend record.

The surge in travel will not be driven by weather, as this Labour Day weekend is forecasted to be the coolest in 16 years.

United Airlines says it expects more than 3 million passengers this holiday weekend, nearly 250,000 more than last year. American Airlines is preparing for almost 4 million travelers across more than 36,000 flights, marking its largest-ever Labor Day operation.

The Federal Aviation Administration has already reported that summer 2025 has been historic, with more than 5 million flights nationwide, the busiest summer travel season in over 10 years.

Despite consumer balance sheets deteriorating, tariffs increasing prices, and other negative economic conditions, consumers are continuing to spend on experiences.

Trump’s guy

President Trump has been highly critical of the Federal Reserve since moving into the Oval Office for his second term. He has sparred with Chairman Powell and called for his resignation and has even threatened to fire him. He has also sparred and is threatening to fire Lisa Cook, a member of the FED who has recently been accused of mortgage fraud. Cook is contesting Trump’s decision.

Why is Trump doing this? He wants interest rates to decrease and wants more allies at the FED. Lower interest rates would be a huge win for Trump from multiple fronts, including financial market performance, employment rates, and housing.

Despite nominating Chairman Powell in 2018 for his position, Trump does not like Powell. Trump will look to replace Powell next year (when Powell’s term expires) with an ally.

Over the last few weeks, it was revealed that Trump will nominate a very close ally to serve on the FED (there is currently a temporary open seat). President Trump announced in a social media post a few weeks back that he would be nominating Stephen Miran, chair of the Council of Economic Advisers, for the open position. Miran is the architect of many of President Trump’s economic initiatives, and his office is currently inside the White House.

So far, we have not stated anything new. This report was known to us over two weeks ago. The piece we wanted to talk about was a report that came out earlier this week. Reportedly, Trump is considering Miran for the longer-term seat currently held by Governor Lisa Cook (remember, Trump is currently threatening to fire Cook).

So, who is Stephen Miran? Miran is a Harvard grad who has worked in both the private and public sectors.

Miran gave the public a view of some of his thoughts through an interview he gave Barron’s this past Monday. Here are his thoughts:

- Supports the government’s decision to invest in private companies like the deal with Intel, but believes taxpayers should still be protected

- No evidence this cycle that tariffs have been inflationary but there could be moderate inflation

- The labour market is currently in a good place, and will continue to improve as illegal migrants are deported

- Supports constant improvement in the government

- The U.S. economy is still healthy

Regardless of how you feel about these thoughts, Miran will be a person to watch moving forward. If Trump stuffs the FED with his allies, we could see the end of the FED’s independence and monetary policy decisions being made by partisan politicians, and not by economists.

Canada’s largest bank’s earnings

Royal Bank returned to the top of the list of Canada’s largest companies (in terms of market capitalization) on Wednesday after a strong earnings report (Shopify surpassed Royal Bank after a strong start to 2025). Shares moved up by more than 5% on Wednesday morning after an EPS and revenue beat. Royal Bank reported quarterly earnings of $3.84 versus a street estimate of $3.32. Quarterly revenue beat street estimates by almost $1 billion. Net income for the quarter rose 21% year-over-year, and adjusted diluted EPS increased by 18% YoY. Royal Bank saw broad-based revenue growth with Personal Banking up 13%, Commercial Banking up 6% and Wealth Management client assets up 12% (all YoY). Capital markets revenue jumped by 25% driven by corporate and investment banking.

Royal Bank also reported a strong capital position in its earnings report. The company also reported a quarterly dividend increase; shares are now yielding 3% (as of this writing).

In a statement, the company’s CEO highlighted the bank’s growth, resilience, and continued investment in technology, human capital, and risk management as key factors driving this strong performance. Royal Bank highlighted a number of factors in their quarterly MD&A, including creating client value, accelerating their growth in the U.S., continuing to invest in high-end talent, and improving operational efficiency.

The strong report comes at a time of evolving economic conditions. Royal Bank has continued to separate itself relative to the other large Canadian banks through revenue growth, strategic acquisitions, financial stability, and prudent risk management. Royal Bank is also a North American leader in digital and AI strategy. Royal Bank ranked second to JPMorgan amongst North American banks in terms of innovation and an AI readiness assessment, according to the Evident AI Banking Index. Royal Bank is now larger in terms of market value than the combined value of TD Bank (Canada’s second largest bank) and CIBC (Canada’s fifth largest bank).

Overall, this was a great quarterly report by Royal Bank. Shares are up over 15% so far this year and up over 25% over the last year. Shares are currently still attractive in our view from a Forward P/E, EV/Revenue, and EV/EBITDA perspective. Royal Bank shares currently trade below 15x forward earnings.

Beyond Royal Bank’s actual earnings, we noticed something very interesting: mortgage delinquencies were the highest in Toronto and jumped YoY.

Disclaimer: MacNicol & Associates Asset Management holds shares of Royal Bank of Canada (RY: TSX) across various client accounts.

Historic run

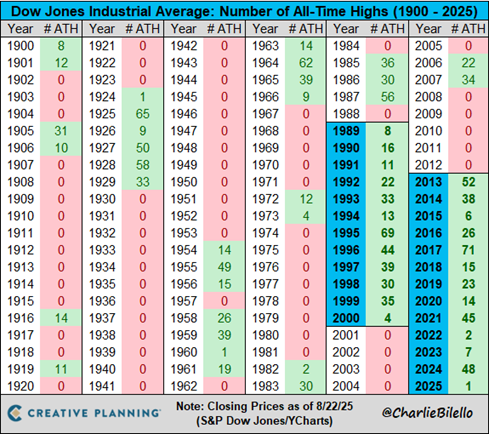

Last week, the Dow Jones Industrial Average closed at an all time high. This is the first time in 2025 that the Dow has done so. The Dow Jones has closed at least one session at an all-time high every year since 2013, surpassing a 12-year streak from 1989 to 2000.

The bull market streak that we are on has lasted four presidential terms and goes all the way back to Obama’s second term. Quite the run.

Even in down years, the market has seen all-time highs. The Dow’s first all-time high of 2025 came a few months behind the high growth indices, like the Nasdaq and S&P 500 saw their first all-time highs of 2025. We think a balanced approach (growth and value) to portfolios will deliver the best results moving forward. We also believe that asset class diversification through precious metals, short-term debt, and alternatives will improve returns and minimize portfolio risk. Finally, we believe portfolios should have protection in case there is a Black Swan event or a large, volatile drop across markets. Currently, there are limited options for investors to get insurance for these events, but we created a fund that allows for this. Our MacNicol Safe Harbour Fund launched last year and provides portfolio insurance to unit holders against their equity holdings. Our fund invests indirectly in the Black Swan Protection Protocol fund operated by Universa Investments.

To learn more about our Safe Harbour Fund, visit this page below and set up a call with one of our Portfolio Managers:

Safe Harbour Fund – MacNicolAsset.com

Disclaimer: MacNicol & Associates Asset Management (MAAM) operates an Alternative Asset Trust in which its investors hold units. MAAM also holds shares of mutual funds, trusts, and ETFs that invest in precious metals across various client accounts. MAAM operates a portfolio insurance vehicle that invests in an options strategy that seeks to profit during volatile drawdowns by the S&P 500; the Safe Harbour Fund launched last November, and MAAM investors hold shares of this private fund.

MacNicol & Associates Asset Management

August 29th, 2025

Download in PDF format:

The Weekly Beacon August 29 2025 US